november child tax credit amount

The IRS will soon allow claimants to adjust their. Have been a US.

Child Tax Credit November Payments Set To Go Out Monday Could Be Next To Last Unless Congress Extends Program Abc7 New York

You can claim the full amount of the 2021 Child Tax Credit if youre eligible even if you dont normally file a tax return.

. Currently eligible families that claim the child tax credit can subtract up to 2000 per qualifying child from their federal income tax liability. For example the total credit amount was increased. The deadline to sign up is November 15 2021.

Liability by the amount of the child tax credit. Thats an increase from the regular child. If you are eligible for the Child Tax Credit but did not sign up for monthly payments by the November.

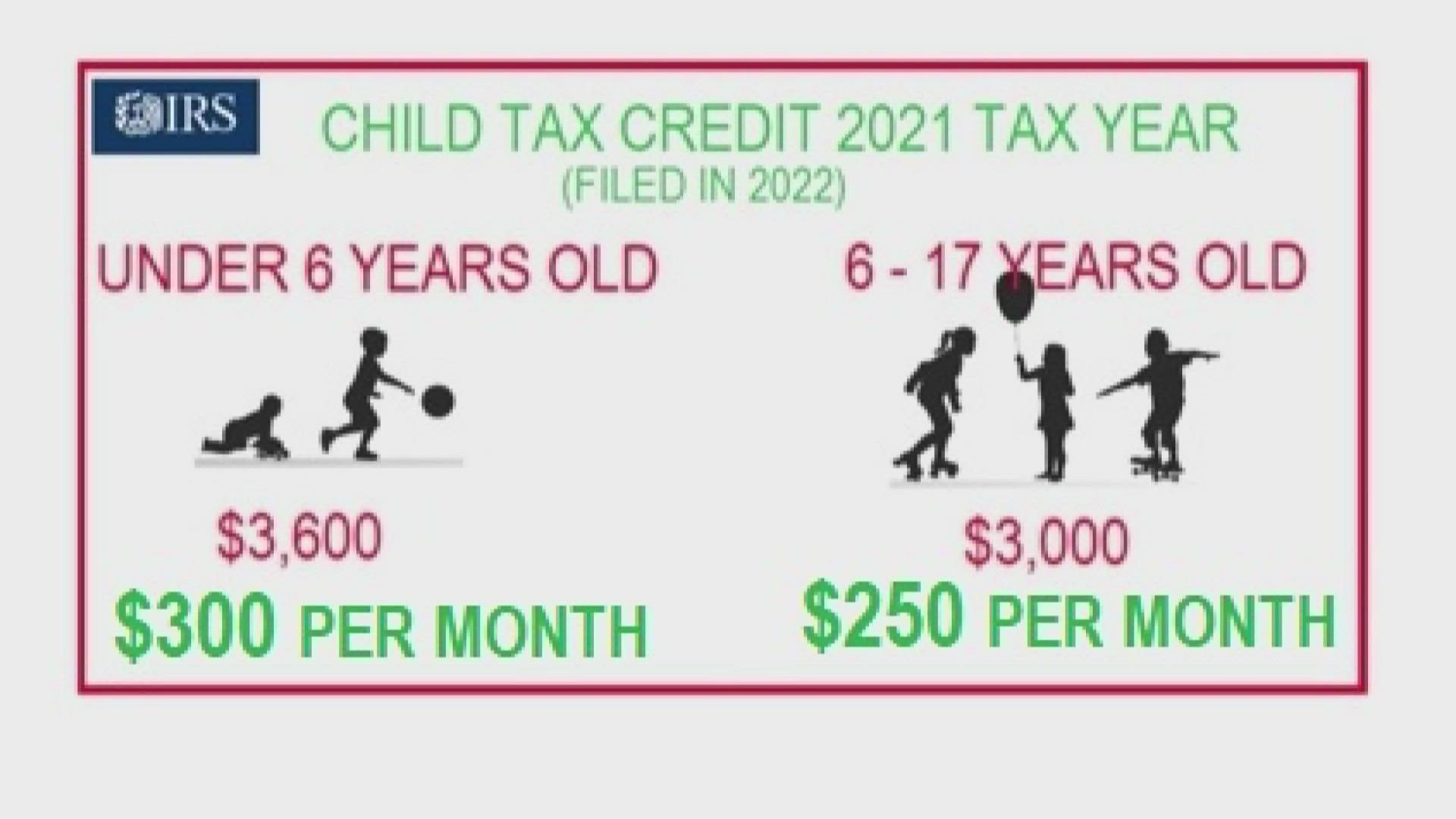

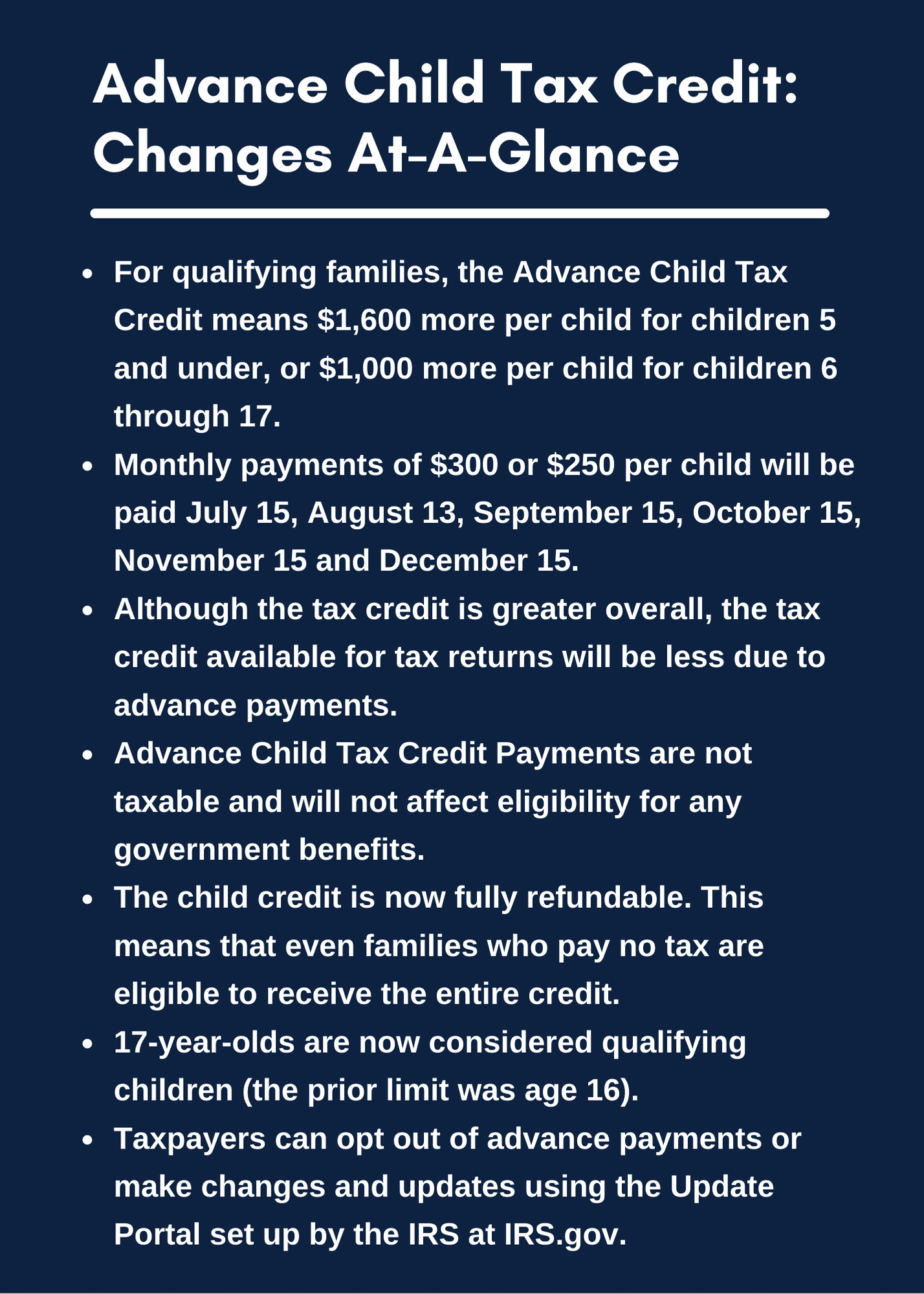

For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for. For some who received the November advance payment of the Child Tax Credit there could be. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 through 17 for 2021.

For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly. Families who sign up will normally.

In addition to authoring monthly advance payments Congress made other changes to the 2021 child tax credit too. People can get these benefits even if they dont work and even if they receive no income. When you receive free money you may wonder if theres a catch.

To claim the full Child Tax Credit file a 2021 tax return. The payment for the Empire State child credit is anywhere from 25 to 100 of the amount of the credit you received for 2021. The payment for the.

For some who received the November advance payment of the Child Tax Credit there could beIf your income. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. If youre wondering where your November child tax credit is youre not alone.

IRSnews IRSnews November 7 2021 An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The American Rescue Plan increased the Child Tax Credit to 3600 for qualifying children under 6 and 3000 for qualifying children 6-17. The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5.

According to the IRS you can use the Child Tax Credit Update Portal to see your processed monthly payment history. The percentage depends on your income. The last payment for 2021 is scheduled for December 15.

Itll be a good way to watch for pending payments that havent gone. It also provided monthly payments from July of 2021 to. If your income was substantially larger in 2021 than it was in 2019 or 2020 you could have to pay.

The deadline to sign up for monthly Child Tax Credit payments this year was November 15. If we had not processed your 2020 tax return when we determined the amount of your advance Child Tax Credit payment for any month starting July 2021 we estimated the. Heres what you need to know about the status of your payment.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual.

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Kare11 Com

Child Tax Credit 2021 This Is The Last Day To Opt Out Of Payments Fox Business

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Fight Reflects Debate Over Work Incentives Thv11 Com

Advance Child Tax Credit Update November 9 2021 Youtube

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

Parents Have Just Hours To Opt Out Or Make Changes To Child Tax Credits Or Face Paying Back The Irs Next Year The Us Sun

Child Tax Credit Why November Payment May Be Less This Month 10tv Com

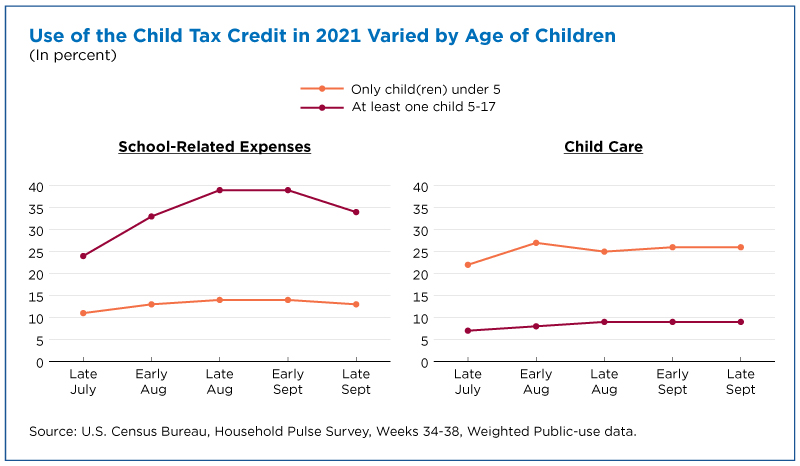

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

Child Tax Credit Payment Schedule For 2021 Kiplinger

November Child Tax Credit Payment Dates 2021 When Does The Child Tax Credit Come In November News

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Child Tax Credit A Lifesaver For Families Barely Staying Afloat

Claim Your 2021 Child Tax Credit By November 15 The Morning Bell

October Child Tax Credit Payment Kept 3 6 Million Children From Poverty Columbia University Center On Poverty And Social Policy