nanny tax calculator uk 2020

If your employee earns under 123 per week gross they will not be eligible for any statutory payments such as. If you agree a net of 2000 per month and nanny has no deductions other than tax and NI then your total cost each month is.

Nannytax Nanny Payroll Services For Uk Employers Nannytax

However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

. We go the extra mile to make sure you are properly looked after. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator. For a competitively priced annual fee we remove all the worry that can.

Were here to help. When caregivers are paid on the books they gain access to unemployment insurance social security medicare. NannyMatters have provided professional nanny payroll services and expert tax advice for parents since 2002.

Updated for the 2022-2023 tax. Calculate your caregivers pay now. Tax Calculator for 202021 Tax Year.

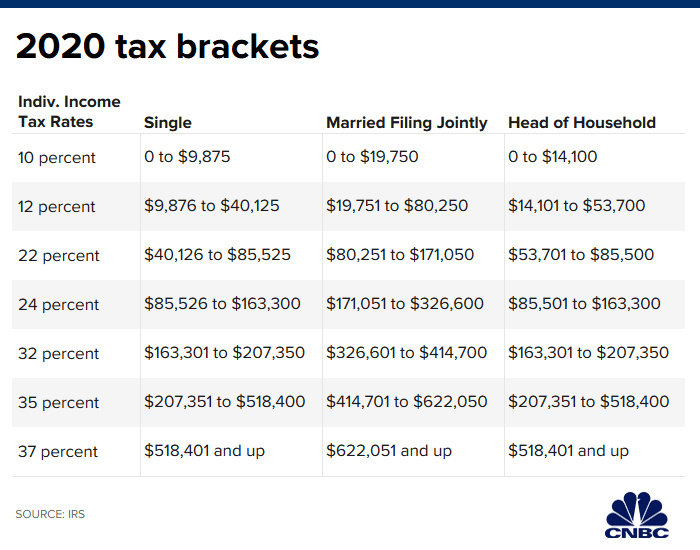

Select the tax code to use or specify other eg for a nanny share or more than one job calculations I confirm the calculation parameters as shown. 11 income tax and related need-to-knows. Transfer unused allowance to your spouse.

From 06072022 onwards between 242 and 967. Our nanny tax calculator will help you to calculate nanny pay and determine your tax responsibility as a household employer whether paying a nanny a senior care worker or other household. Our new address is 110R South.

Income Tax Calculator is the only UK tax calculator that is EASY to use FREE. The Nanny Tax Company has moved. Negotiate a gross salary with your employee.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. Find out the total cost of employing. This calculator assumes that you pay the nanny for the full year.

For an exact calculation based on salary actual tax code and employment status telephone our help desk Mon Fri 0930 am 500 pm 020 8642 5470 or e-mail us at. The Nanny Tax Company has. This tells you your take-home.

Tax calculators and tax tools to check your income and salary after deductions such as UK tax national insurance pensions and student loans. For tax year 2021 the taxes you file in 2022. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

The employer will see the tax saving not the nanny. Our nanny payroll service is paid for by your employer but you also get access to our experts at no charge to you. Then print the pay stub right from the calculator.

Calculation is for April 2022 to. This is based on the 20222023 tax year using tax code 1257Lx and is relevant for the period up to and including 050722 this will be updated again. Free tax code calculator.

GTM Payroll Services provides this calculator as a means for obtaining an estimate of tax liabilities but should not be used as a replacement for formal calculations and does not. Cost Calculator for Nanny Employers. Many Employees want a net salary but we recommend agreeing a gross for numerous reasons.

The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis. Check your tax code - you may be owed 1000s. Here is the IRS publication.

Try out the take-home calculator choose the 202223 tax year and see how it affects. Calculate your salary take home pay net wage after tax PAYE. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year.

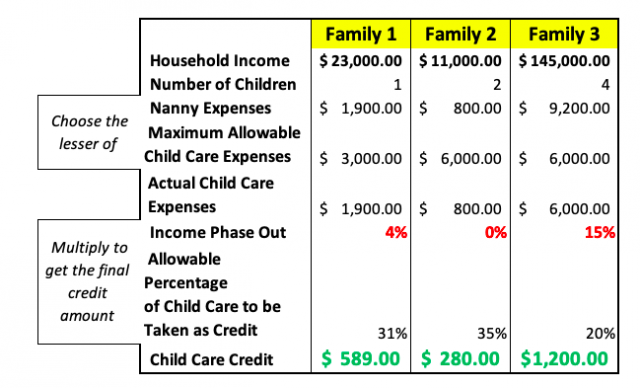

The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two. Nanny tax calculator uk 2020. Use The Nanny Tax Companys hourly nanny tax calculator to calculate nanny pay and withholding.

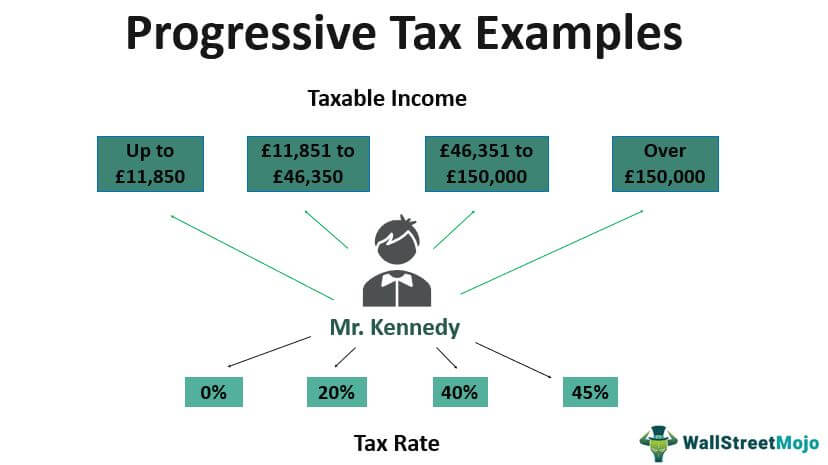

Progressive Tax Examples Top 4 Practical Examples With Calculation

Nanny Salary Pension Calculator Gross To Net Nannytax

How Do I Claim The Childcare Element Of Working Tax Credit Low Incomes Tax Reform Group

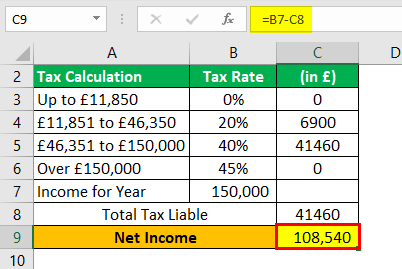

Corporate Tax Meaning Calculation Examples Planning

Nannytax Interviews Nanny Of The Year 2020 Nannytax

Can I Deduct Nanny Expenses On My Tax Return Taxhub

Provision For Income Tax Definition Formula Calculation Examples

7 Ways You Can Earn Tax Free Income The Motley Fool

Tax Credits And Coronavirus Low Incomes Tax Reform Group

Nanny Salary Pension Calculator Gross To Net Nannytax

Are You Using The Trading Allowance Correctly Low Incomes Tax Reform Group

Progressive Tax Examples Top 4 Practical Examples With Calculation

Here S Why Actually The Irs 600 Bank Reporting Proposal Is Entirely Reasonable